Essential Strategies for Managing Debt While on a Furlough

Essential Strategies for Managing Debt While on a Furlough

The COVID-19 pandemic has profoundly impacted the UK economy, triggering extensive furloughs and layoffs in various industries. Consequently, many individuals are facing severe financial challenges, especially the daunting task of managing their debts while coping with a drastic decrease in income. If you find yourself furloughed for an extended duration and struggling with debts, it can be overwhelming, particularly when your earnings are reduced to 80% of your usual salary. However, with careful planning and proactive financial strategies, you can navigate this difficult period successfully. Here’s a guide to help you regain control over your financial situation during these turbulent times and work towards building a more secure financial future.

1. Create a Customized Monthly Budget Based on Your Current Income

Begin the process by developing a customized monthly budget that accurately reflects your current financial reality. This budget should account for your reduced income while also identifying potential areas for savings. Take the opportunity to analyze your spending habits and consider reallocating funds from non-essential categories, such as entertainment, dining out, and luxury items, to cover your essential expenses and savings goals. By prioritizing your financial commitments and minimizing discretionary spending, you can craft a sustainable budget that allows you to manage your debts more effectively while also preparing for any unforeseen financial challenges that may arise in the future.

2. Investigate Additional Income Sources to Offset Your Reduced Salary

To ensure you can continue meeting your debt obligations, it’s essential to find ways to offset the impact of the 20% pay cut. Look into alternative income opportunities, such as freelance gigs, part-time jobs, or side hustles that can provide extra cash flow. Additionally, consider cutting back on expenses by canceling rarely used subscriptions or optimizing your grocery shopping habits. Implementing a budget-friendly meal plan can significantly lower your monthly food costs. By actively seeking these savings and diversifying your income, you will be in a stronger position to fulfill your debt commitments and prevent falling behind during your furlough.

3. Evaluate Debt Consolidation Loans for Simplified Payment Management

Consider applying for debt consolidation loans for bad credit. These financial instruments can streamline your repayment strategy by consolidating multiple debts into a single, manageable monthly payment. This approach not only reduces the confusion surrounding various due dates and amounts owed but also facilitates clearer financial planning. For individuals on furlough, a <a href=”https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/”>debt consolidation loan</a> can offer a structured method to manage a limited income while alleviating the stress associated with juggling multiple payment schedules, ultimately assisting you in restoring your financial stability.

4. Formulate a Strategic Plan for Long-Term Financial Security

While you navigate your current financial hurdles, take the time to reflect on your long-term financial goals, which might include purchasing a home or starting your own business. Clearly defining these aspirations can serve as a motivating factor in improving your financial standing. Utilizing a debt consolidation loan can also positively impact your credit score over time, enhancing your chances of qualifying for a mortgage or business loan under more favorable conditions. By planning methodically and focusing on your financial objectives, you can lay the groundwork for success and work towards achieving greater financial independence as you progress.

For additional support and professional advice on managing your finances during these challenging circumstances, and to discover how <a href="https://limitsofstrategy.com/understanding-good-debt-and-bad-debt-a-clear-guide/">debt consolidation loans</a> can benefit furloughed employees, please feel free to contact Debt Consolidation Loans today.

If you are a homeowner or business owner, connect with the experts at Debt Consolidation Loans today to find out how a debt consolidation loan can enhance your financial well-being and overall stability.

If you believe a Debt Consolidation Loan aligns with your financial aspirations, do not hesitate to reach out to us or call 0333 577 5626. Take the pivotal first step towards improving your financial status with a single, manageable monthly payment.

Essential Financial Resources for Comprehensive Guidance and Support:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Can You Successfully Consolidate Your Medical Loan? Explore Your Options

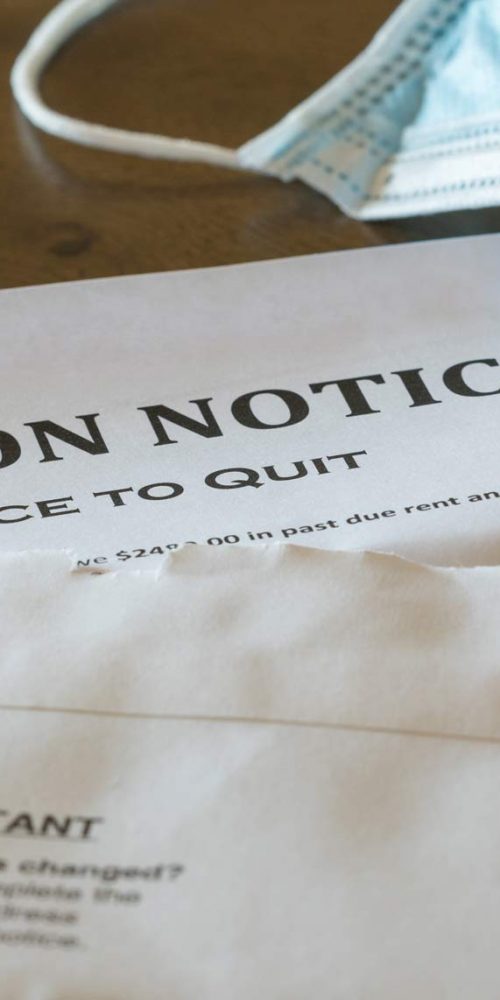

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March: Key Information You Need to Know

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Effective Approaches to Quickly Escape Debt

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Exploring the Pros and Cons of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Maximize Your Financial Strategy with Our Debt Consolidation Loan Calculator

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On https://limitsofstrategy.com

The Article Furloughed and in Debt? Essential Steps to Take Now First Appeared ON

: <a href="

Comments are closed